OneZero, Amy Martyn

Uber Freight says its app offers drivers more transparency and consistent earnings, but some truckers are worried it won’t help them for the long haul

Inthe summer of 2019, Richard Hernandez, an Arkansas truck driver, took what seemed like a straightforward job: Move 40,000 pounds of peanuts from the Planters factory in Fort Smith, Arkansas, to the Sam’s Club Distribution Center in Searcy, Arkansas, for $680. He found the job through Uber, which since 2017 has been in the trucking business. There was just one problem: When he arrived at Planters, he learned that the load weighed 45,000 pounds, not 40,000. The extra 5,000 pounds would impact his profit — independent truckers’ “freight rate,” or how much they’re paid per mile, typically increases with heavier loads because the extra weight affects their gas mileage. His trailer was already loaded, but Hernandez decided he would refuse to drive anywhere until Uber increased his pay.

“I’ll tell them to take that shit right back off the truck,” he says of disputes like these. “I’m not going to haul your extra freight for nothing.”

Arguing with Uber’s support line requires patience. Hernandez was prepared. After a three hour standoff in the Planters lot, and about a dozen calls to the Uber hotline, he says he finally got through to someone who agreed to add an extra $300 to his tab. As a truck driver with 25 years of experience, Hernandez felt that Uber’s mistake was typical of the “shady” behavior of other freight brokers he’s worked with over the years. When Uber launched its platform for truck drivers, Uber Freight, in May 2017, the idea was to upend the trucking industry, similar to what it did with taxis. On Uber Freight, truck operators are akin to other Uber drivers, while the shipper is the customer. Truck companies or truck drivers who work as independent owners/operators select from a list of open jobs with up-front pricing.

Uber has famously never been profitable, and the pandemic didn’t help. Uber Eats did better than ever but still managed to lose $232 million in the first quarter of 2020, signaling that food delivery may not be an easy route to profitability, and demand for ride-sharing has cratered since the onset of the pandemic, with Uber reporting a 72% decline in ridership during the quarter after U.S. cities issued their first stay-at-home orders. But demand in the freight industry — the business of moving products around the country — is strong. So it seems natural that Uber is now doubling down on its trucking app, which the company has claimed “is revolutionizing the logistics industry.” In October, Uber announced that its Freight division raised $500 million from a private equity firm, the Greenbriar Equity Group, which subsequently valued Freight at $3.3 billion.

Uber has also taken new steps to attract and retain truck drivers during the pandemic. Uber Freight in June introduced a “Thank a Trucker campaign” that offered care packages and other incentives to keep drivers working, and has previously partnered with nonprofit groups like the Women in Trucking Association. In its pitch to independent truckers, Uber has said that Freight will eliminate the stress of finding and booking jobs and will allow truckers “to go out on their own and be in control of their earnings.”

But more than a dozen independent truck drivers, employees or owners at small trucking companies, and advocates for truckers interviewed by OneZero say the app doesn’t live up to this promise. Instead, they compare it to third-party logistics firms or freight brokers, the middlemen that truckers have long depended on to find jobs. Major trucking companies like C.H. Robinson, XPO, and TQL already have their own freight brokerage arms that arrange billions of dollars worth of deliveries each year with outside truckers they hire as independent contractors. Truckers are also seeing a growing number of digital freight brokers — including Amazon’s platform Relay — that much like Uber, connect truckers to shippers through an app.

“I’m not going to haul your extra freight for nothing.”

“The problem that Uber is trying to solve really isn’t something that has not been solved at this point,” says Brad Saeger, the owner of a small trucking company in the Midwest. Some of the key selling points of Uber Freight, like predetermined rates and replacing a live salesman with an app, can make it difficult to correct mistakes and negotiate pricing. Saeger says he tried Uber Freight three times, and that with each order, Uber provided the wrong information and then never compensated his company for it. “I’m just not even going to bother calling them anymore because all of their loads are garbage.”

Some truckers say that the real formula behind Uber’s logistics “revolution” is the same one that has powered the app-based economy all along: Cheaper rates for shipping customers at the expense of the labor that makes it possible. That feeling is echoed by labor experts, who say that the trend toward app-based trucking is designed to further drive down pay and working conditions for American truckers who have already seen their pay plummet since 1980.

In a statement, an Uber Freight spokesperson says that “this is a simplification of the logistics industry and a mischaracterization of how rates are set in the logistics industry.”

“Uber Freight’s approach from the beginning was to provide transparent and up-front pricing and enable carriers and their drivers to book loads with the touch of a button,” the statement says.

As examples of how Uber Freight differs from others in the industry, the spokesman points to Uber Freight’s Bundles and Dedicated Lanes features, which allow drivers to book multiple jobs together to ensure they have a job on a return trip and to book dedicated routes up to three months in advance, respectively. “Carriers tend to choose Uber Freight because they value the transparency, ease of booking, and the technology-driven features that assist them with optimizing their time and making more consistent earnings — all benefits that are not available via traditional brokerages,” the spokesman adds.

But even some truckers who regularly book loads on Uber Freight are doubtful that the app will do anything to help them in the long-term. “I think they’re just trying to increase their profit margin,” added Hernandez, the trucker who strong-armed Uber into paying him $300 for the extra peanuts last year.

Lewie Pugh saw potential for Uber Freight, hoping it would correct some of the mistakes of its predecessors and help truckers who might have difficulty booking good loads at the other firms. A former driver, and the current executive vice president of the Owner-Operator Independent Drivers Association, Pugh says that Uber’s sales team reached out to his organization in 2017 for feedback ahead of Freight’s launch.

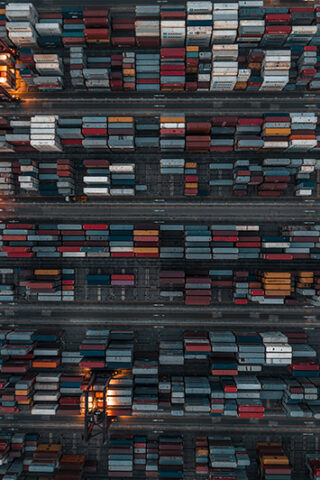

An estimated 70% of the nation’s freight reaches its destination thanks to truck drivers, yet drivers say they feel like they are the most dispensable part of the operation. Ask a truck driver what would improve their working conditions, and their requests are modest. Truckers want to be guaranteed pay for detention, or the hours they are detained at a shipping site when a customer is running more than two hours late. They need more sites to safely park overnight so they can get sleep after a 14-hour workday. And they want higher pay. To survive, independent truckers live and die by whatever the going rate is for freight. Freight rates can vary widely depending on a number of factors, including distance of the delivery, the amount of labor required to load and unload, and how soon the load needs to be moved. From a trucker’s perspective, it’s often not possible to pinpoint the reason for decreasing rates — are they due to a change in demand? Or middlemen increasing their take?

“They take a lot of advantage of the truckers. TQL sucks,” says a woman filling her truck up at a stop in Long Beach, California, referring to Total Quality Logistics, the second-largest freight broker in the nation with $687 million in profits last year. The woman, who declined to give her name, says she decided to quit her office job to become a truck driver after her children grew up. The best part of the job is the freedom. The hardest part is dealing with freight brokers and shipping clients who don’t want to pay detention fees.

Under federal law, truckers have the right to find out how much freight brokers are making on each job. But in practice, truckers say they give up that right when they sign contracts with the major firms. According to a TQL trucking agreement obtained by OneZero, TQL “is not required to disclose its charges to customers, commissions, or brokerage revenue,” and truckers must waive their right under federal law to ask for that information. TQL declined to comment.

Mike Matousek, the director of government affairs at the Owner-Operator Independent Drivers Association, says drivers would never get away with trying to exempt themselves from any of the federal regulations they must abide by. Regulators at the Federal Motor Carrier Safety Administration and law enforcement “would get a good laugh out of that,” he says, yet “brokers have been getting away with this for decades.”

Uber advertises that truck drivers on its platform will get “guaranteed rate transparency,” and that freight rates are determined by an algorithm. But Uber declined to say what percentage it makes on jobs, and like TQL and others, requires drivers to waive their right to broker transparency. “As with most other brokers, carriers waive their rights under that federal regulation as part of their carrier agreements,” Uber Freight says.

When Uber asked Pugh to weigh in on its contract for truckers, he suggested reworking the sample contract by guaranteeing detention pay and providing truckers with more legal protections in the event of damaged goods, among other suggestions. Uber eventually got back to him to say that their attorneys rejected all of his suggestions, he says. An Uber Freight spokesman told OneZero that “we did incorporate modifications into our carrier agreement based on OOIDA feedback,” but declined to provide specific examples.

According to truckers interviewed by OneZero, Uber Freight pays detention on a case-by-case basis, but getting the money is not easy. Truckers say they feel like they are arguing with an app rather than an actual salesperson. Joseph Aljebuori, a trucker who tried Uber Freight because the app was easy to use, says that Uber has never paid him for detention time. In one instance last year, he says he arrived at the Dollar General distribution center in Missouri two hours ahead of his scheduled appointment, which is the norm. But Dollar General was running late — more than 11 hours late, to be exact. In the end, he says he spent 13 hours detained at the Dollar General lot without getting detention pay. In a statement, Uber Freight says that under its current detention policy, drivers are paid $40 an hour for detention, but only for a maximum of five hours. The spokesman says that the driver in this case was paid a flat $200 layover fee for the wait at Dollar General.

“They pay fast, they pay pretty good, and they pay fast.”

One of Uber’s key selling points is that its up-front pricing will save drivers from the hassle of negotiating. “With Uber Freight, the price you book is the price you’re paid,” Uber says. But truckers say that this feature works to their disadvantage when they are demanding detention or fees for other unexpected issues that are common in trucking.

“That’s their way out, if they don’t agree to it on the rate con [the contract], they’re going to tell you they don’t have to pay it,” says Mark Kuhn, a truck driver in North Carolina, who says that he was stranded with a trailer full of Hanes socks for three days when Uber Freight gave the wrong information about a delivery to Dollar General.

With established brokerage firms, truckers typically deal with the actual broker or another single point-of-contact who they can easily reach by phone. But with app-based services like Uber, truckers say that the only live humans they talk to are anonymous customer service representatives who seem to be based overseas and are reading from scripts.

On jobs that span across several states, dispatchers with Uber Freight have called as often as every 45 minutes to check the status of the delivery, says driver Tony King. “More often than not, anyone who works for them has what I like to call the foreign understanding of the scale and size of the United States,” he says.

At the same time, when unexpected problems arise, truckers say that the Uber customer support team never has immediate answers. Instead, the call center workers put drivers on lengthy holds and eventually write “support tickets” that don’t go anywhere unless the trucker follows up with emails or more phone calls.

“Their account management is very, very poor on the trucking side,” says Courtney Perkins, a dispatcher for a trucking company in South Carolina whose firm has taken Uber Freight jobs including moving damaged merchandise to a thrift store and delivering air conditioners to a construction site that had no loading dock. In one instance, she says that Uber Freight provided the wrong appointment time, costing her company $1,000 because her driver was unable to make his next job as a result. “We use it as kind of a stand-in,” Perkins says, “like a last resort kind of place.”

A perhaps more generous name for being the last resort is to be in the “spot market,” or the term the logistics industry uses for booking freight jobs at the last minute. An Uber blog post highlights the spot market as a key area for growth.

About a year ago, Uber Freight offered competitive freight rates compared to others in the spot market, according to Ruzhdi Aliev, the owner of a truck company in Wyoming that specializes in spot orders. But the rates have since plummeted and are now among the bottom, he says. His impression is that Uber lowered freight rates after it recruited more truck drivers. “As soon as they had enough [truckers], they flipped the switch.”

If some of this sounds familiar, it’s because longtime drivers on the traditional Uber app have also complained about decreasing pay and poor account management. According to one 2018 study by the JP Morgan Chase Institute, a growth in ride-share drivers was accompanied by a 53% decline in driver earnings. And after Uber replaced some customer support representatives with contractors in the Philippines and India, ride-share customers and drivers said that their serious complaints went nowhere. Uber nevertheless in February laid off 80 customer support representatives in Los Angeles and indicated some of their roles would be filled by workers in Manila.

Uber Freight disputes that it has poor customer service, writing that Freight offers “24/7 carrier support, has a dedicated carrier sales team and continues to invest heavily in improving service for carriers and shippers alike.”

The spokesperson says that Uber Freight approves an average of nine out of 10 detention requests and closes out each request on an average of 33 minutes. “We have an automated, unbiased internal process that reviews each request fairly and quickly by leveraging GPS data and the carrier’s submitted in/out times to handle requests,” the spokesman writes.

Uber Freight also says that its freight rates in 2020 are better on average than they were in October 2019. “Freight’s rates are on par with market rates and reflect market conditions,” the statement says.

“Run all your competition out of business, you’d be the sole provider making a crap ton of money.”

Two truckers who were interviewed by OneZero say that they like using Uber Freight, though one acknowledged that he was still waiting for Uber to pay him after a lengthy detention. The other driver, Robert Murphy, says he regularly finds good rates on Uber Freight when he is in California and looking for a job that will take him to Arizona or Nevada. Murphy points out that Uber Freight does not charge “quick pay” fees, the industry term for fees that freight brokers deduct if drivers want to get paid faster than a month.

Since he joined Uber Freight, Murphy says that its rates on detention have dropped from $75 an hour to $40. But the freight rates leaving California have remained solid. “They pay fast, they pay pretty good, and they pay fast,” he laughs.

Long before Silicon Valley glamorized the idea of gig work, the trucking industry had already adopted the model. Between 350,000 and 400,000 truck drivers on the road are the owners and operators of their own truck and one-person business. According to one study by the National Transportation Institute, truck drivers would be paid $111,000 if their wages in 1980 were adjusted for inflation. Instead, the median annual pay of truckers is now at $45,260, according to the Bureau of Labor Statistics. At the same time, financial analysts say that the third-party logistics market will be worth $1.56 trillion by 2027. The growth of the freight brokerage industry and the drop in trucker pay dates back to the Motor Carrier Act of 1980, a federal law that deregulated the price of freight after the logistics industry had previously been treated as a public utility. Labor groups like the Teamsters union (which represented most drivers prior to the 1980 law) argue that deregulation has been a boon to the trucking industry at the expense of the actual truckers.

In recent years, income from the app-based gig economy has also been dropping as more and more people looking for work join the platforms. “What [Uber] has done with ride-hailing is to kind of flood the market with workers who are cruising around looking for rides,” says William Gould, a Stanford Law School professor who served as chairman of the National Labor Relations Board in the 1990s. Truck drivers “are more unprotected than they ever have been,” Gould says, and he sees an Uber-like service for truckers as one that will ultimately be “to the detriment of truckers because that kind of model is designed to get a lot of people in the field competing with one another.”

Tony King, an Indiana trucker who has been driving for seven years, occasionally uses Uber Freight even though he doesn’t like it. He believes that Uber’s ultimate goal with Freight is to be just like all the other freight brokers, and perhaps eventually become as powerful as the bigger firms. “Ultimately, that’s I guess more or less the American dream,” he says. “Run all your competition out of business, you’d be the sole provider making a crap ton of money.”